Compliance of Tax Estimation and Advance Instalment of a Company

What is a tax estimation and advance tax payment ?

As a result of the change from Official Assessment System to Self-Assessment System in 2001, companies are required to estimate and pay their estimated tax by monthly instalment, in advance, although actual tax return will only be submitted later. There are two possibilities when a company prepares its tax return with actual tax payable, either (i) to top up more tax as the actual tax is more than the monthly instalment OR (ii) get a tax refund from the Inland Revenue of Malaysia (IRBM)

Such monthly advance tax instalment will add to cash outflow of any company. Thus proper financial planning and monitoring is recommended. Companies are strongly advised to monitor their monthly accounts and cash flow properly in order to avoid unnecessary.

How to comply?

i) For newly incorporated companies or recommence business after being dormant

A newly incorporated company is required to estimate its tax payable via a prescribed Form CP204 within 3 (three) months after its commencement of business. However, IRBM do allow eligible Small Medium Companies (SME) to be exempted from such estimation of tax payable for 2 years of assessment (YA). Please refer to our article on SMEs’ definition.

Example 1

TLT F&B Sdn Bhd was incorporated on 02.01.2022 and commenced its business on 08.01.2022. The Board of Directors fixed its first financial year end (FYE) from 02.01.2022 to 31.12.2022 and 31st December for subsequent financial year end (FYE). The paid-up capital of the company is RM500,000-00 and no corporate shareholder.

Solution

The company must submit e-CP204 on or before 31.03.2020 and to opt for the 2 YAs, ie YA 2020 and 2021 for exemption on estimation of tax payable since it fulfils as a SME.

Example 2

Deli F&B Sdn Bhd was incorporated on 02.01.2022 and commenced its business on 08.01.2022. The Board of Directors fixed its first financial year end (FYE) from 02.01.2022 to 31.12.2022 and 31st December for subsequent FYE. The paid-up capital of the company is RM2,500,000-00.

Solution

• The company must estimate its tax payable by submitting e-CP204 on or before 31.03.2020.

• CP 205 & CP 207 of schedule of payment and payment slip will be issued respectively by IRBM for taxpayer to make payment

• The first (1st) instalment will be due on the 15th of the 6th month of its accounting period, ie 15.06.2022

ii) For existing companies

Existing companies are required to submit their estimated of tax payable 30 days before the beginning of the next basis period (BP) of that YA via a Form CP204.

The estimation of tax payable for a year of assessment shall not be less than eighty-five per cent (85%) of the revised estimate of tax payable for the immediately preceding year of assessment or if no revised estimate is furnished, shall not be less than eighty-five (85%) per cent of the estimate of tax payable for the immediately preceding year of assessment.

First instalment will be due on or before 15th of the second month of that YA and subsequent instalment also due on or before 15th of each month.

Example 3

PQR Enterprise Sdn Bhd estimated tax in YA 2022 (Basis Period : 01.08.2021 – 31.07.2022) at RM10,000-00 and is require to estimate for YA 2023.

Solution

The company is not allowed to estimate less than 85% or RM8,500-00 for YA 2023.

The first instalment will be due on or before 15th Sept 2022.

Fortunately, IRBM do provide consideration and may accept estimation of tax payable of less than 85% provided good reason and evidence is supported for the appeal.

Can a company revise its estimated tax ?

Companies are allowed to revise their estimated tax payable of a YA in the 6th and 9th month of that BP by submitting Form CP204A.

Companies are advised to plan their cash flow properly in order to comply this requirement and yet do not affect their cash flow.

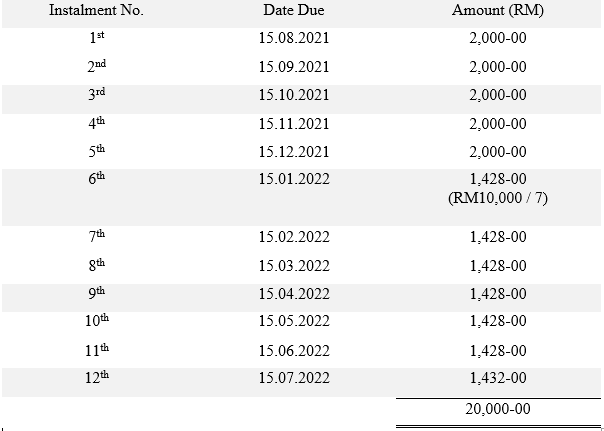

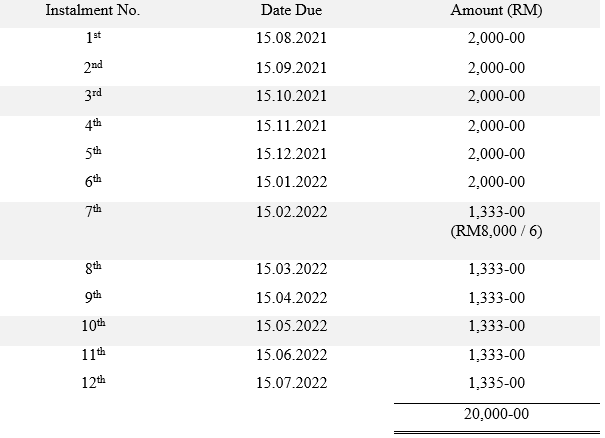

Example 4

DEF Enterprise Sd Bhd estimated tax in YA 2022 (Basis Period : 01.07.2021 – 30.06.2022) at RM24,000-00. The company decided to revise its tax payable to RM20,000 in the 6th month of the BP.

Solution

Assumption 1 : The company revised it before 15th of 6th month of a BP

Assumption 2 : The company revised it after 15th of 6th month of a BP

The same principal will apply in the event the company wanted to revised again in 9th month of the BP.

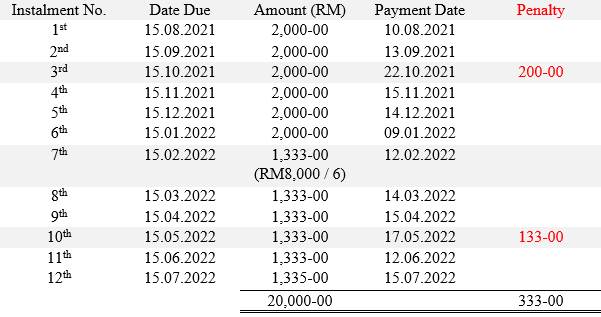

What happen if a company has defaulted in its instalment ?

If a company has defaulted its instalment, the amount unpaid shall, without any further notice being served, be increased by a sum equal to ten per cent (10%) of the amount unpaid, and the amount unpaid and the increase on the amount unpaid shall be recoverable as if it were tax due and payable.

Hence, companies are hereby reminded to monitor and pay promptly failing which ten per cent (10%) penalty will be imposed.

Example 5

LMN Manufacturing Sdn Bhd has the following revised estimated of tax and failed to pay promptly.

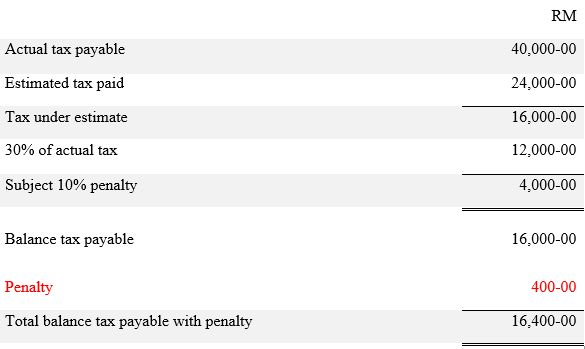

What happened if a company under estimated its tax ?

Where the tax payable under an assessment for a YA of a company exceeds the revised estimate or deemed revised estimate, whichever is later, or if no such revised estimate is furnished or there is no such deemed revised estimate, the estimate of tax payable for that year of assessment, by an amount of more than thirty per cent (30%) of the tax payable under the assessment, then, without any further notice being served, the difference between that amount and thirty per cent (30%) of the tax payable under the assessment will be increased by a sum equal to ten per cent (10%) of the amount of that difference, and that sum will be recoverable as if it were tax due and payable.

The following example demonstrates better on the ten per cent (10%) penalty after the thirty per cent (30%) difference compare to actual tax payable and revised or original estimated tax payable as explained above.

Example 6

XYZ Electrical Sdn Bhd with FYE 01.08.2020 to 31.07.2020 has paid its revised estimated tax RM24,000-00. The company computed its actual tax and submitted with IRBM RM40,000-00.

Disclaimer

The contents of this article intends to share on a general understanding basis and are not intended to suit any particular individuals and/or organisation without further consulted professional advice. The writer shall not be held and accepts no liability or responsibility on whatsoever loss, damage, expense or cost to any party resulting directly and/or indirectly from the use, application and /or referral of this materials and /or contents and/or the reliance by any party, either in part or in whole.