Definition for SMEs

A business will be classified as an SME if it fulfils all the three (3) conditions in regards to the (A) Qualifying Criteria, (B) Type of Establishment and (C) Shareholding Structure as below :

(A) Qualifying Criteria Meet either one of the two specified qualifying criteria, namely sales turnover or full-time employees, whichever is lower.

- Manufacturing sectors

- SME is defined as a firm with Sales turnover ≤ RM50 million OR Number of full-time employees ≤ 200 employees.

- Services or Other sectors

- SME is defined as a firm with Sales turnover ≤ RM20 million OR Number of full-time employees ≤ 75 employees.

(B) Type of Establishment Pure business entity that is:

- Locally incorporated under the Companies Act 2016 (replaced Companies Act 1965) ; or

- Registered under the Registration of Business Act (1956) or Limited Liability Partnerships (LLP) Act 2012; or

- Registered under respective authorities or district offices in Sabah and Sarawak; or

- Registered under respective statutory bodies for professional service providers.

(C) Shareholding Structure

- Companies that are public-listed in the secondary bourses such as the ACE market, Malaysia Online Trading Platform for Unlisted Market (MyULM) or in secondary markets / SME exchanges / unlisted markets in other countries and their subsidiaries will be considered as SMEs.

- Public-listed companies in the main board such as Bursa Malaysia or main bourses in other countries and their subsidiaries will not be considered as SMEs.

- Subsidiaries of large firms, multinational corporations (MNCs), Government-linked companies (GLCs), Syarikat Menteri Kewangan Diperbadankan (MKD) and State-owned enterprises will not be considered as SMEs.

- Subsidiaries of other entities can be deemed as SMEs if both the parent entities and subsidiaries fulfil the SME definition.

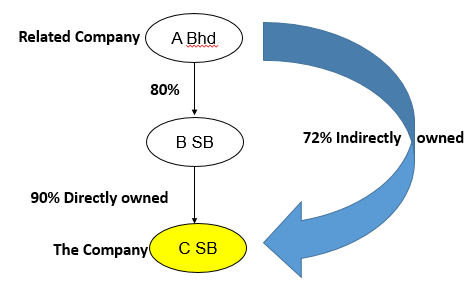

- 50% of the paid up capital in respect of ordinary shares of the company is directly or indirectly owned by a related company (see diagram 1).

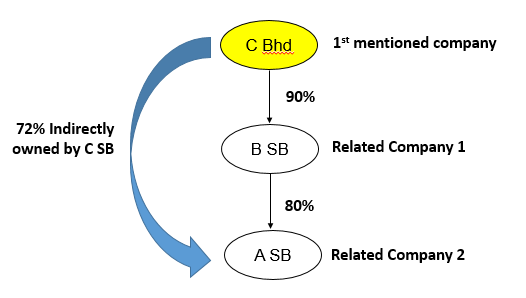

- 50% of the paid up capital in respect of ordinary shares of the related company is directly or indirectly owned by the first mentioned company (see diagram 2).

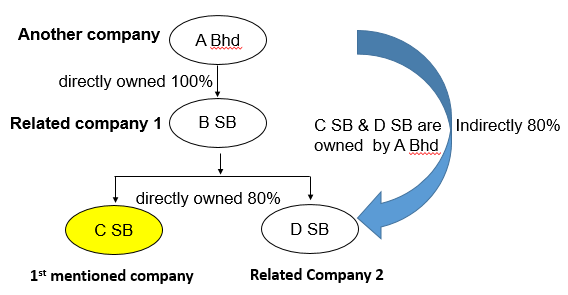

- 50% of the paid up capital in respect of ordinary shares of the first mentioned company and the related company is directly or indirectly owned by another company (see diagram 3).

Diagram 1

Diagram 2

Diagram 3

Tax Rate

|

|

|

|

|

|---|---|---|---|

|

|

Preferential Rate | Normal Rate | |

|

|

Companies with paid-up capital (Ord Shares) and LLP with total contribution of RM2.5 mil and less and fulfilled as SMEs | 17% on chargeable income of RM600K and below | 24% above chargeable income of RM600K |

|

|

Companies other than SMEs (wef YA 2022) | 24% on chargeable income of RM100 mil and below | 33% above chargeable income of RM600K |

Disclaimer

The contents of this article intends to share on a general understanding basis and are not intended to suit any particular individuals and/or organisation without further consulted professional advice. The writer shall not be held and accepts no liability or responsibility on whatsoever loss, damage, expense or cost to any party resulting directly and/or indirectly from the use, application and /or referral of this materials and /or contents and/or the reliance by any party, either in part or in whole.