Real Property Company

Shares transfer and shares registration of a private company limited by shares are no new issues to company secretaries. However, a company secretary must be able to advise his client whether a transaction of transfer of shares involve shares in a real property company (RPC), if so, the chargeable gain will subject to real property gains tax as such shares are treated as real properties under the Real Property Gains Tax Act 1975 (RPGTA).

Background

At one time, it was possible for the members of a land-based companies to avoid paying tax even though making gains on the disposal of their shares, as they did not dispose property. As a result of such a loophole, the tax authority suffered huge loss on tax revenue collection. Share transfer tax was then introduced on 19.10.1984 in order to tax on the share disposal price at 2% on the members instead of the gains made on disposal of share in a land-based company. It was the opinion from the general public that the share transfer tax was not within the spirit of tax revenue collection as it was taxed on the disposal price instead on the gains. It was unfair to pay share transfer tax in a situation of loss making disposal of share in a land-based company!

Therefore, on 21.10.1988 Para 34A of Schedule 2 of the RPGTA was introduced to repealed and replaced the share transfer tax. Para 34A of Schedule 2 of the RPGTA deals with any chargeable gains arising from the disposal of shares in a RPC. It serves to prevent tax avoidance on the disposal of shares in a RPC and to meet the spirit of tax revenue collection.

What is Real Property Company

A RPC is defined as a ¹control company where :-

(a) As at 21.10.1988 owns ²real property and / or ³shares or both in a RPC, ⁴the defined value of which is not less than 75% of ⁵the value of its total tangible assets ; or

(b) At any date after 21.10.1988 acquires real property and / or shares or both in a RPC, the defined value of real property or shares or both owned at that date is not less than 75% of the value of its total tangible assets

The following examples will explain better in respect of a RPC.

Example 1

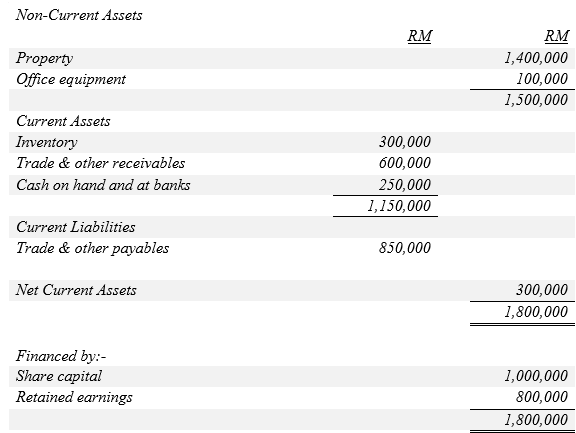

AA Sdn Bhd (AA) is a control company and has the following balance sheet as at 31.12.2015.

Balance Sheet as at 31st December, 2019

The defined value is about 77.78% (real property divided by total tangible assets x 100%), thus AA is a RPC.

Acquisition Price

There are two methods of determination of acquisition price under two different scenarios. During the acquisition of shares of a company, the relevant company could be a RPC (scenario 1) or a non-RPC (scenario 2) but subsequently turn into a RPC.

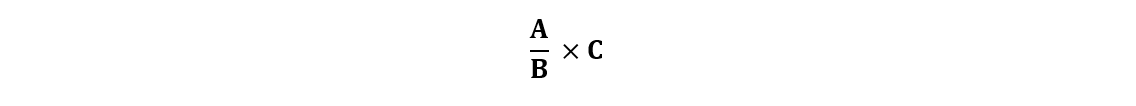

In the above first mentioned scenario, the acquisition price would be the consideration or market value of the real property pursuant to Paragraph 9 of Schedule 2 of the RPGTA. It is thus a straight forward approach to determine the acquisition price. However, under the above second scenario, a formula is used to calculate the acquisition price. It is calculated based on the value of the real property in the RPC against the percentage of shares acquired over the issued shares of the RPC. Paragraph 34A(3) Schedule 2 of the RPGTA determines the following formula for the acquisition price of shares :-

Where,

A = is the number of shares deemed to be a chargeable asset ;

B = is the total number of issued shares in the relevant company (the RPC) at the date of acquisition of the chargeable assets ; and

C = is the defined value of the real property or shares or both owned by the relevant company (the RPC) at the date of acquisition of the chargeable assets

The following Example 2 will demonstrate a better understanding of how to calculate the acquisition price of shares in a non-RPC when it turns into RPC AND the determination of RPC status of the acquirer.

Example 2

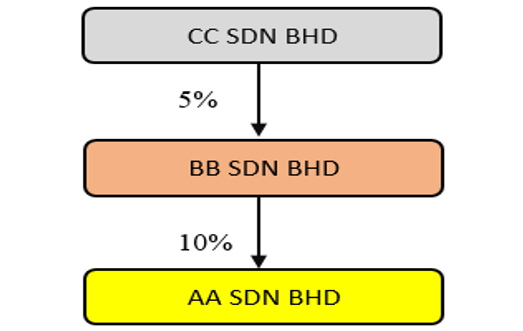

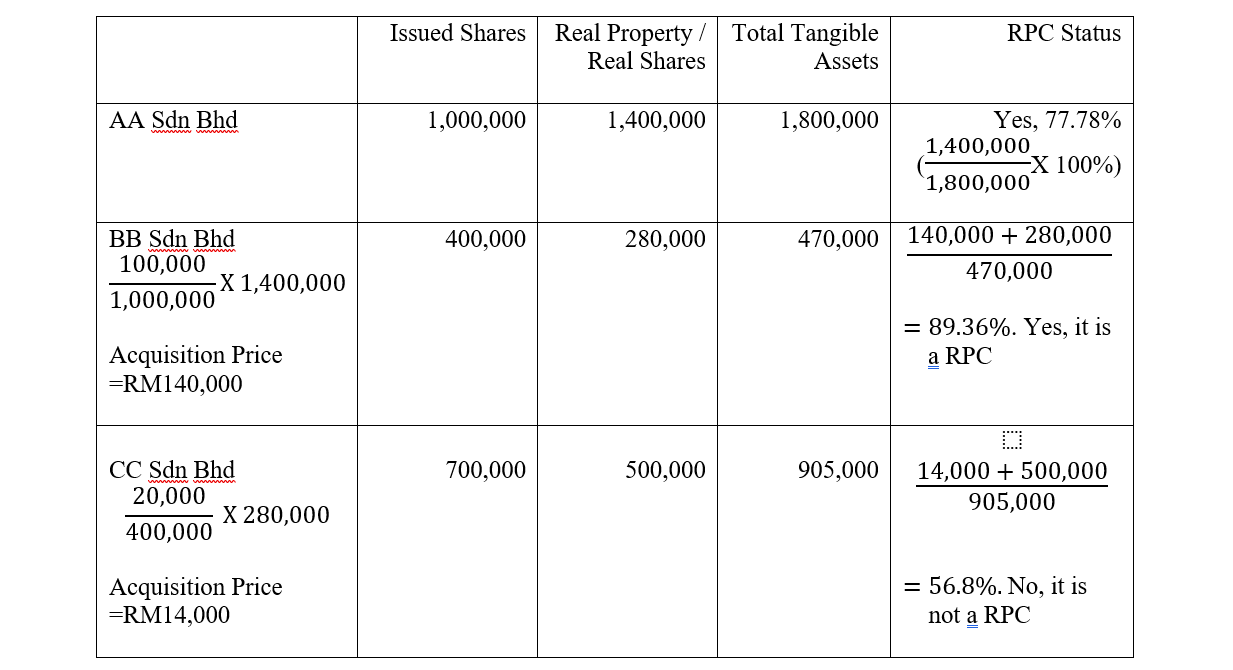

Example continues from the above where CC Sdn Bhd (CC) owned 5% shares of BB Sdn Bhd and BB Sdn Bhd (BB) owned 10% shares in AA with the following information for the determination of RPC status.

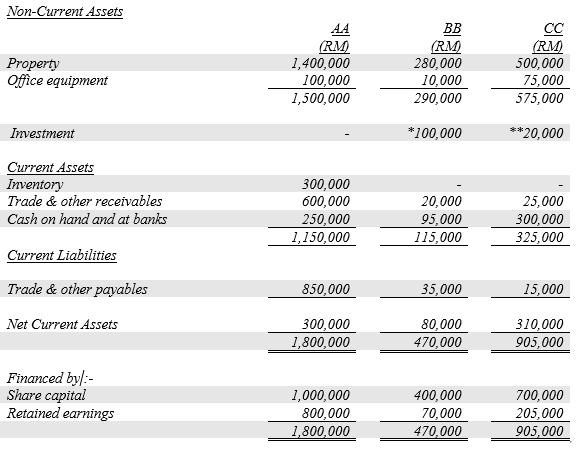

Balance Sheet as at 31st December, 2019

* The investment of RM100,000 in the Balance Sheet of BB Sdn Bhd is the investment of 10% share capital in AA Sdn Bhd ;

**The investment of RM20,000 in the Balance Sheet of CC Sdn Bhd is the investment of 5% share capital in BB Sdn Bhd

Workings for the determination of RPC status of BB Sdn Bhd and CC Sdn Bhd.

Acquisition Date

In accordance with paragraph 34A(2), an chargeable asset (RPC shares) is deemed to be acquired :-

(a) On the date where the relevant company becomes a RPC ; or

(b) On the date of acquisition of a chargeable asset.

Effective from 17.10.1997, the acquisition date of the shares would not move forward or change to the date when a company acquire additional chargeable assets (RPC shares and /or real property). Unlike prior to 17.10.1997, a new date of acquisition will be taken as the date of acquisition each time when there is acquisition of chargeable assets. Such a new date of acquisition will affect the higher acquisition price in most cases, therefore Inland Revenue Board has decided to amend it on 17.10.1997.

If a member in a RPC acquires shares in different timing, he thereby will have different acquisition dates and prices (commonly known as different block of shares) for RPGT purpose.

Example 3

Assuming En Hamid Omar acquired shares in CC Sdn Bhd (a RPC as per above example 2) on the following dates :-

|

|

|

|

|

|

|---|---|---|---|---|

|

|

No. | Dates of acquisitions |

No of shares acquired |

Date of disposal |

|

|

1 | 01.03.2016 |

10,000 | 01.04.2020 |

|

|

2 | 15.05.2017 | 20,000 | 01.02.2020 |

|

|

3 | 20.07.2018 | 30,000 | 31.05.2020 |

In view of the above scenarios, En Hamid Omar has 3 blocks of RPC shares acquisitions in CC Sdn Bhd. Hence each block of the acquisition price would be varied.

Disposal of shares in a RPC

Real property gains tax is charged on gains arising from the disposal of shares in a RPC. Disposal price would be the amount of consideration whether it is money or kind with money’s worth of the disposal of chargeable assets. Schedule 5 of Part1, II and III of the RPGTA list the following tax rates :-

Disposal by an individual who is a Malaysian citizen or Permanent Resident (wef 01.01.2019)

|

|

|

|

|---|---|---|

|

|

Date of Disposal |

Rates of RPGT (%) |

|

|

Dispose in the 3rd year after the date of acquisition |

30 |

|

|

Dispose in the 4th year after the date of acquisition |

20 |

|

|

Dispose in the 5th year after the date of acquisition |

15 |

| Dispose in the 6th year after the date of acquisition or thereafter | 5 |

Disposal by a Company (wef 01.01.2019)

|

|

|

|

|---|---|---|

|

|

Date of Disposal |

Rates of RPGT (%) |

|

|

Dispose in the 3rd year after the date of acquisition |

30 |

|

|

Dispose in the 4th year after the date of acquisition |

20 |

|

|

Dispose in the 5th year after the date of acquisition |

15 |

| Dispose in the 6th year after the date of acquisition or thereafter | 10 |

Disposal by an individual who is not a Malaysian citizen or Permanent Resident (from 1st Jan 2019)

|

|

|

|

|---|---|---|

|

|

Date of Disposal |

Rates of RPGT (%) |

|

|

Dispose within 5 years from the date of acquisition |

30 |

|

|

Dispose after 5 years from the date of acquisition or thereafter |

10 |

Example 4

Continue from above example 3, En Hamid Omar has 2 disposals where the rate on the disposal would depend on the holding period of the shares in CC Sdn Bhd.

(a) The holding period of the first block of shares disposal was in the 5th year after the acquisition. Hence, 15% of the RPGT is chargeable on the chargeable gain.

(b) The holding period of the second block of shares disposal was within the 3rd year after the acquisition. Thus, 30% of the RPGT is chargeable on the chargeable gain.

Ceased to be a RPC

A RPC may be ceased from the status of RPC when its defined value is reduced below 75%. However, the RPC shares holding by the existing shareholders are remained as RPC shares. See below example for better understanding.

Example 5

Continue from above examples 3 and 4, assuming on 01.05.2020 the defined value of CC Sdn Bhd is less than 75%, it would then ceased as a RPC. However, the balance 30,000 shares that En Hamid Omar is holding are still RPC shares. Therefore, the disposal of 30,000 shares on 31.05.2020 to En Rajoo are still RPC shares and subject to RPGT should there is a chargeable gain.

Summary and Conclusion

Directors are hereby reminded to be mindful on the 75% defined value where a company will turn into a RPC ! They are advised to engage tax consultant not only for tax compliance but for other purpose in relation to tax matters, to determine the RPC status of a company, for instance.

¹ A control company is defined under the Income Tax Act 1965 (ITA) whereby it is controlled by not more than five (5) persons and having not more than fifty (50) members.

² A real property is defined under the RPGTA as any land situated in Malaysia and any interest, option or other right in or over such land.

³ Shares means all of any of the following :-

a) Stocks and share in a company ;

b) Loan stock and debentures issued by a company or any other corporate body, whenever incorporated ;

c) A member’s interest in a company not limited by shares whether or not it has a share capital ;

d) Any option or other right in, over or relating to shares as defined in above paragraphs (a) to (c)

⁴Defined value is the market value of real property or the acquisition price of shares.

⁵ The value of its total tangible assets means the aggregate of the defined value of real property or shares or both and value of other tangible assets.

Bibliography

- Real Property Gains Tax Act 1972

- Income Tax Act 1967

- Alan Yeo Miow Ching – Advanced Malaysian Tax

- Veerinderjet on Taxation

Disclaimer

The contents of this article intends to share on a general understanding basis and are not intended to suit any particular individuals and/or organisation without further consulted professional advice. The writer shall not be held and accepts no liability or responsibility on whatsoever loss, damage, expense or cost to any party resulting directly and/or indirectly from the use, application and /or referral of this materials and /or contents and/or the reliance by any party, either in part or in whole.